Application FAQs

general application

- How do I upload documents?

-

My Home By Pennymac makes uploading documents easy. Drag and drop your documents from your device into the portal. You can even log in using your mobile device, snap a quick photo to upload.

- What paperwork do I need to locate before starting my application?

-

We make it simple to add your assets and liabilities, and verify your income. All you need is your social security number, bank account login and employer info.

- Do I need a separate login?

-

If you are an existing Pennymac customer, good news—you can log in with your Manage My Loan credentials. If you do not have an existing login, please register.

- How do I benefit from having a Mortgage Success Team?

-

Your Mortgage Success Team is dedicated to ensuring your loan is closed promptly and efficiently. They will be there for you every step of the way to guide you and answer any questions that may arise throughout your homebuying journey.

understanding your journey

- What happens during the Application Milestone?

- A Loan Officer will take your initial application and discuss the best product based on your needs. The Loan Officer will also begin to request initial documents needed to start the review process.

- How do I check the status of my loan?

- My Home By Pennymac is the best place to check on the status of your loan. The major steps are listed on the left side of the screen.

- What happens during the Closing Milestone?

- Your closing date is scheduled and your closing documents are being finalized and sent to the title or escrow company to be signed by you.

- What happens during the Conditional Approval Milestone?

- Our internal review teams will complete the initial review of your application. This review includes a check of your income, assets, credit, appraisal and title. If we are able to complete our initial review your loan will be Conditionally Approved. Further review may be needed before your loan is Final Approved.

- What happens during the Document Collection Milestone?

- Our internal review teams will gather any further documentation that is needed to complete the initial review of your application. Based on the product you chose with the Loan Officer, some applications require minimal documentation.

- What happens during the Final Approval Milestone?

- Your loan application is fully approved and we are ready to schedule your closing. You will receive an Initial Closing Disclosure in the next 24 hours to show you the current figures. Acknowledge you have received this document ASAP, to secure the earliest available closing date.

- What happens during the Loan Funded Milestone?

- Pennymac has completed the funding of the loan. If you chose a cash-out refinance loan, your funds will be sent to you and often arrive via carrier within 48-72 hours after your signing.

understanding requests

- What are Additional Document Requests?

- Any new document requests made during the loan review phase will be located in this folder. You may click on the tile to see any open requests.

- What are E-sign/E-Disclosure Requests?

- Any documents or disclosures that require either your signature or an acknowledgement will be located in this folder.

- Where are the documents I’ve uploaded?

- All documents that you upload in My Home By Pennymac can be found within “My documents” on the Loan Details page, along with your journey update and loan summary.

- What are Initial Document Requests?

- This refers to any documents that were requested by your loan officer during your loan application. You may click on the tile to see any open requests.

mortgage payments

- Do I need to make my payment this month? Can I skip 2 payments?

- Payments of existing mortgages should always be made on time to avoid late fees and to ensure we can close on your new loan without delays. The closing date of your loan application will determine when the first payment date on your new loan begins.

- Should I turn off my automatic/auto-draft payments?

- If you currently have a Pennymac loan and intend to pay off that loan with your new loan application, you should not make any changes to auto-draft payments until your new loan application has funded. You will receive an email notifying you once the loan has funded.

avoiding application delays

- I need to make a big purchase (example: Car purchase), will this be an issue?

- We advise all borrowers to avoid making large purchases during your loan application process. Large purchases, whether added to an existing credit card or the creation of a new credit line, may change your debt-to-income ratio used to approve your loan. A significant increase in your debt may risk the approval of your loan application. During the application process, any changes to your credit can affect your ability to be approved. It’s best to hold off on any big changes to your credit until you’re approved.

- May I email requested documents to Pennymac?

- The most secure and efficient way to provide us with your personal documents is through My Home By Pennymac. This will also ensure that your documents are reviewed promptly.

- Why do I need evidence of Flood Insurance?

- Properties identified as being located in a flood zone require proof of flood insurance, to ensure you have coverage in the event of a flood.

- Refinances: Pennymac will provide you a flood certificate, which you will need to sign and return back to us along with proof of an existing flood insurance policy.

- Purchases: You need to provide one of the following:

- A complete flood insurance policy containing the following mortgagee clause: PennyMac Loan Services, LLC Its Successors And/Or Assigns, P.O. Box 6618, Springfield, Ohio 45501-6618

- A complete application to the National Flood Insurance Program Agency (NFIP) with evidence that the first year premium on the policy has been paid and an elevation certificate if the property was constructed after the date on the FIRM.

frequently used mortgage terms

- What is an appraisal?

- Most loan products require an appraisal to determine the value of your home. Appraisals are completed by a third party vendor. The value of your home along with the requested loan amount are used to determine the Loan to Value amount. This figure determines whether a borrower is required to add Private Mortgage Insurance.

- What is an escrow account?

- Simply put, an escrow account is a holding account that allows homeowners to pay their annual property tax bill and homeowners insurance in installments as part of their regular monthly mortgage payment.

Supplemental tax bills are generally not paid from the escrow account. Supplemental tax bills must be paid directly by the borrower to the taxing authority.

NOTE: With certain loan products, an escrow account is required. - What does a lien on the title report mean?

- A lien gives an individual or entity a claim to a property until a debt that the lien represents has been paid off in full. It is not uncommon to have another lien on title – they may represent another lender, a tax lien, a judgement lien by court order, solar panel loan, or a contractor, among others.

- What is Private Mortgage Insurance (PMI)?

- Private mortgage insurance, also called PMI, is an insurance product applied to loans with high loan to value levels. PMI protects the lender from losses if the borrower defaults on the loan. Typically, a borrower will pay for PMI by a monthly premium added to the monthly mortgage payment.

- What is a subordinated lien or subordination?

- A subordinate lien is an item on your title that takes precedence over any other liens you may have on your property. If you were to run into financial trouble, the lien in the first position on your title has the right to be paid off first. Every other lien is subordinate to the first one in terms of being paid off.

Pennymac requires that our lien is held in the first position. This will mean that other liens will need to be moved into a subordinate position. This often adds several weeks to your loan process. Speak to your Mortgage Success Team to learn more.

closing

- What is cash to close?

- Cash to close is the amount a borrower needs to bring to close the mortgage application. This includes money for closing costs like appraisal fees, title insurance or attorney fees, as well as the down payment, origination fees and pre-paid items like escrow funds.

- Why has my cash to close changed?

- There are times when the cash to close changes and is not unusual. This is usually influenced by a change to the loan amount, the closing date, payments made or not made on your existing mortgage and changes in title fees. Your mac team can explain any changes on your specific loan.

- Why does Pennymac request a verification of employment?

- Per lending requirements, Pennymac must verify a borrower is employed with the same company for which the income was verified, within ten days of funding of the loan. This is obtained by a verbal verification over the phone with a representative from your employer.

- Can I use a Power of Attorney?

- A power of attorney can be used in all refinance transactions except a Conventional Cash-out. A digitized version of the power of attorney will need to be approved by Pennymac and the title company before closing can be scheduled and additional documentation may be required. The original power of attorney will need to be presented at the closing table.

funding

- How will my liabilities get paid off?

- The title company will generate checks payable to your creditor and send them via carrier to you. Once you receive these checks, you are responsible for sending off the payment(s) to your creditors.

Note: The amount that will be on the check is the amount on the account at the time we pulled the credit report. If you are still spending or making payments on those cards, you would need to provide an updated statement or payoff prior to approval to have the payoff amounts updated. - I have closed my loan, when should I expect to receive my funds?

- For refinances, there is a 3 bank day waiting period (that’s weekdays plus saturday) in which you are able to rescind the refinance and return to your previous loan terms. This is a federal lending guideline, not a Pennymac policy. Once that time period ends, Pennymac will “disburse” the funds the following business day at which point you should receive your funds within 2-3 business days.

Note: The following states require an extra business day for processing the disbursement: Alaska, California, Connecticut, Iowa, Maine, Maryland, Massachusetts, Minnesota, New Hampshire, New York, Oregon, Rhode Island, Utah, Vermont, and Wisconsin.

For purchases, the funds will be available the same day as signing, except for the following states which require an extra business day for processing the disbursement: Alaska, California, Connecticut, Iowa, Maine, Maryland, Massachusetts, Minnesota, New Hampshire, New York, Oregon, Rhode Island, Utah, Vermont, and Wisconsin.

- Can I have the funds wired to my account?

- Yes. Your notary will have a form for you to complete in order to have your funds directly deposited.

VA loans

- I have a non-vented fireplace, what do I need to do?

- We will need a written acknowledgement stating the dwelling contains a non-vented fireplace or space heater that hasn't been inspected by the VA. We will also need a written statement from a heating/air conditioning contractor that identifies the property and states that the non-vented fireplace is either equipped with an approved Oxygen Depletion Sensor and meets local building authority requirements, or is installed according to the manufacturer recommendations if there are no local requirements.

- Why am I required to have a termite Inspection?

- The VA requires that you get a termite inspection on the house and any other structures on the property. These are both paid at the borrower’s expense. You will need to schedule those inspections with a local pest-control expert as early as possible. The inspection is required to be completed on a specific form called NPMA-33, or on your state's official Termite Inspection form. You can let the pest control company know you're doing a VA refinance, and they should know the correct form to use. You will need to complete this inspection within the first 14 days of your loan application to ensure there are no delays. Please return the termite form to Pennymac with your signature and a date on the first page.

NOTE: There are certain states where a termite inspection is not required up front. These states are: AK, CO, ID, ME, MN, MT, ND, OR, SD, WA, WI, WY. If you live in one of these states, we will need to wait for the Appraisal to be completed before we know if it’s a requirement or not. - Why am I required to have a water/sewage test or inspection?

- The VA has minimum requirements that include adequate, safe, and drinkable water. You will need to contact your local health authority with the city/county, and let them know you're doing a VA refinance and they will be able to help you coordinate a water test. You cannot collect the sample yourself – a licensed authority will need to collect the sample. The well water must meet EPA standards to provide safe drinking water. If the initial well test comes back with requirements, the necessary changes to the well must be made in order to continue with a VA loan.

non-borrowing owner

- I do not want my husband/wife on any documents. (Community property state).

- Anytime a home is purchased after a marriage in a community property state, the spouse automatically owns half of it. So because the property is in a community property state, a spouse is required to sign three specific documents in the closing package. These are known as the Deed of Trust, Notice of Right to Cancel (Rescission) and Closing Disclosure. By having your non-borrowing spouse sign these documents, they are merely acknowledging their awareness of a mortgage on the house. Your spouse will not be on the loan as their name will not be on the promissory note which is the document that denotes a promise to pay back the loan amount that was borrowed.

- What is a Non-borrowing owner?

- A non-borrowing owner is anyone that is on title but is not on the loan application.

- Why does a non-borrowing owner need to sign loan disclosures?

- Anyone that is on the title must also receive and sign the Initial Closing Disclosure, as well as attend closing. This is to ensure the fellow participant on title is aware there is a new lien on the property. We will need their full name and email address so we can send them login credentials for viewing and esigning disclosures.

In some states, a spouse may need to be on title by law. See below for those scenarios. - Is my spouse required to sign documents even though they aren’t on the loan?

- Pennymac requires Non-Borrowing Spouses (NBS) to receive and sign the Initial Closing Disclosure in states with Community property, Homestead or Dower/Curtesy laws. The Closing Disclosure (CD) is the second of the two documents central to disclosure process that follows the Loan Estimate (LE) you have already received. For Texas Cash-out loan (called Texas A(6) loans) the NBS must also sign a Final Closing Disclosure sent 24 hrs before your closing. At Closing, they will also be required to sign the Non-Title Spouse documents (Deed of Trust, Notice of Right to Cancel (Rescission) and Closing Disclosure).

troubleshooting

- Which browsers are compatible with the eConsent/eSigning of Disclosures Process?

-

Current list of supported browser types and versions:

Browser Type Recommended Version(s) Chrome 70 and above Edge 79 and above IE 11 and above Safari 10 and above Firefox 60 and above - My browser is compatible according to your list, but I'm still experiencing issues with eConsent/eSigning of Disclosures. What do I do next?

-

Your browser's cookie settings may need to be updated. Please follow the steps provided below:

- Safari (Mac):

- With Safari open, choose "Safari" from the top-left corner of your screen

- Select "Preferences" from the menu, then "Privacy"

- Uncheck both the "Prevent cross-site tracking" and "Block all cookies" options

-

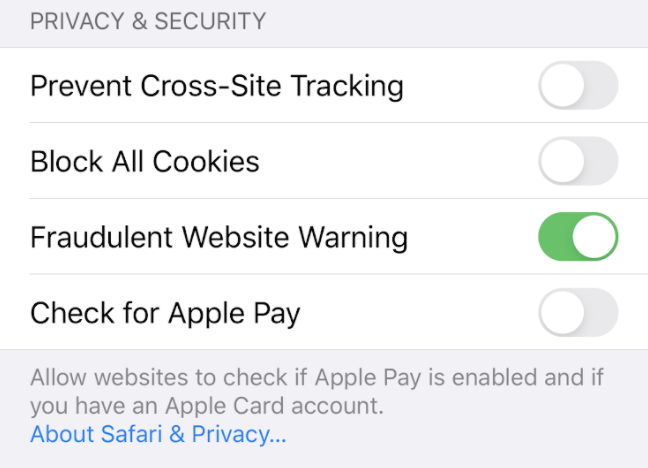

- Safari (iPhone/iOS):

- Open the "Settings" app

- Scroll down and select "Safari"

- Scroll down to the "PRIVACY & SECURITY" section and toggle off both the "Prevent Cross-Site Tracking" and "Block All Cookies" options

-

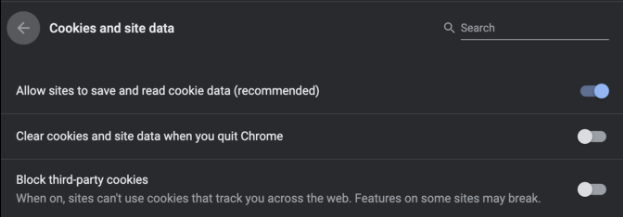

- Google Chrome (all operating systems):

- At the top-right corner of your browser window, click on the three, vertical dots, then "Settings" and choose "Advanced"

- Under "Privacy and Security," select "Site Settings" and then "Cookies and site data"

- Toggle off the "Block 3rd-Party Cookies" option

-

- Safari (Mac):