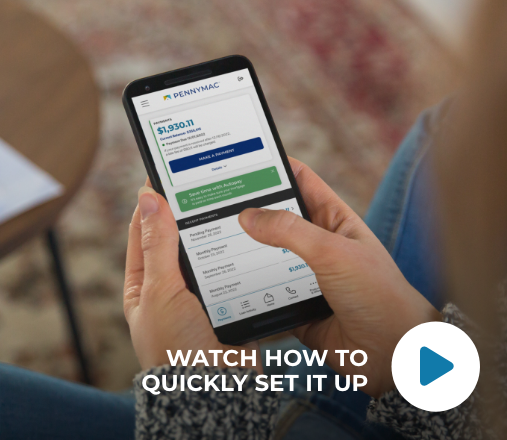

Key steps to get started

Create your

new account

Use your loan number, which is on your Welcome letter and email.

Choose your

preferences

Personalize your loan experience with options in your account to go paperless, select your language preference and more.

Make quick, one-time payments or set up recurring payments

Enroll in paperless statements to cut clutter and keep documents in one place

Set up eDibursements for account refunds

Check your payment history and access documents anytime

Email us using the secure messaging center or chat with us

View and manage escrow, property tax and insurance payments

See why we  our homeowners why they

our homeowners why they  Pennymac

Pennymac

Get to know more about us

Over 5 million homeowners have relied on Pennymac to achieve their aspirations of home since we opened our doors over 15 years ago. As the #2 overall mortgage lender* and a recognized leader in servicing, we offer a full range of personalized solutions including FHA, VA, home equity, and jumbo loans, as well as programs for first-time homebuyers and down payment assistance. We are the Official Mortgage Supporter of the 2026 and 2028 U.S. Olympic and Paralympic Teams, and a Proud Supporter of the LA28 Olympic and Paralympic Games. Learn more about us

Frequently asked questions

Yes, your previous servicer will forward any payments received to Pennymac within 60 days after your loan is transferred, as required by law, and we will credit it to your account without a late fee. All payments received by your previous mortgage company during the 60 days following the date of transfer will be treated as on-time payments and will be forwarded to Pennymac to apply to your account.

No, the terms of your loan do not change as a result of the transfer.

Typically when a home is purchased and there's a change in ownership, property taxes are reassessed by the tax collector and a supplemental tax bill is issued. The supplemental tax bill is a one-time tax, and is sent to you directly, not Pennymac.

Supplemental tax bills are the responsibility of the homeowner and will not automatically be paid from your escrow account. If you cannot pay your supplemental tax bill(s), Pennymac will pay on your behalf; however, this will result in an increased monthly payment.

It could take some time for you to receive a supplemental tax bill, so keep an eye out for it in the mail.

If you are currently making your payments through a bill pay service, we encourage you to sign up for AutoPay through Pennymac AutoPay Monthly or Bi-Weekly programs instead. This ensures that your payments will be received on the day you prefer. If you would rather continue using your bill pay service, please ensure that you have updated the payee information and billing address to our payment processing mailbox as follows: PennyMac Loan Services, LLC, PO Box 30597, Los Angeles, CA 90030-0597

Yes, if you currently have an escrow account for the payment of your taxes and/or insurance premiums, Pennymac will continue collecting these funds and making the payments on your behalf.

We will honor any existing repayment plans, trial modification plans or loan modifications entered into with your prior servicer. Please contact one of Pennymac’s specialized modification representatives for more details. If an application is being evaluated by your prior servicer, we will continue that evaluation.

Have a question?

Chat

Secure Chat is available once you have Registered and Logged In to your account

Phone

Our specialists are here to help you Mon-Fri 5am-6pm | Sat 7am-11am 800.777.4001